Relikon’s Daily 8/22/2025

Bitcoin price today August 22 2025: BTC Steadies Near $113K as Policy Signals Meet Stablecoin Buildout

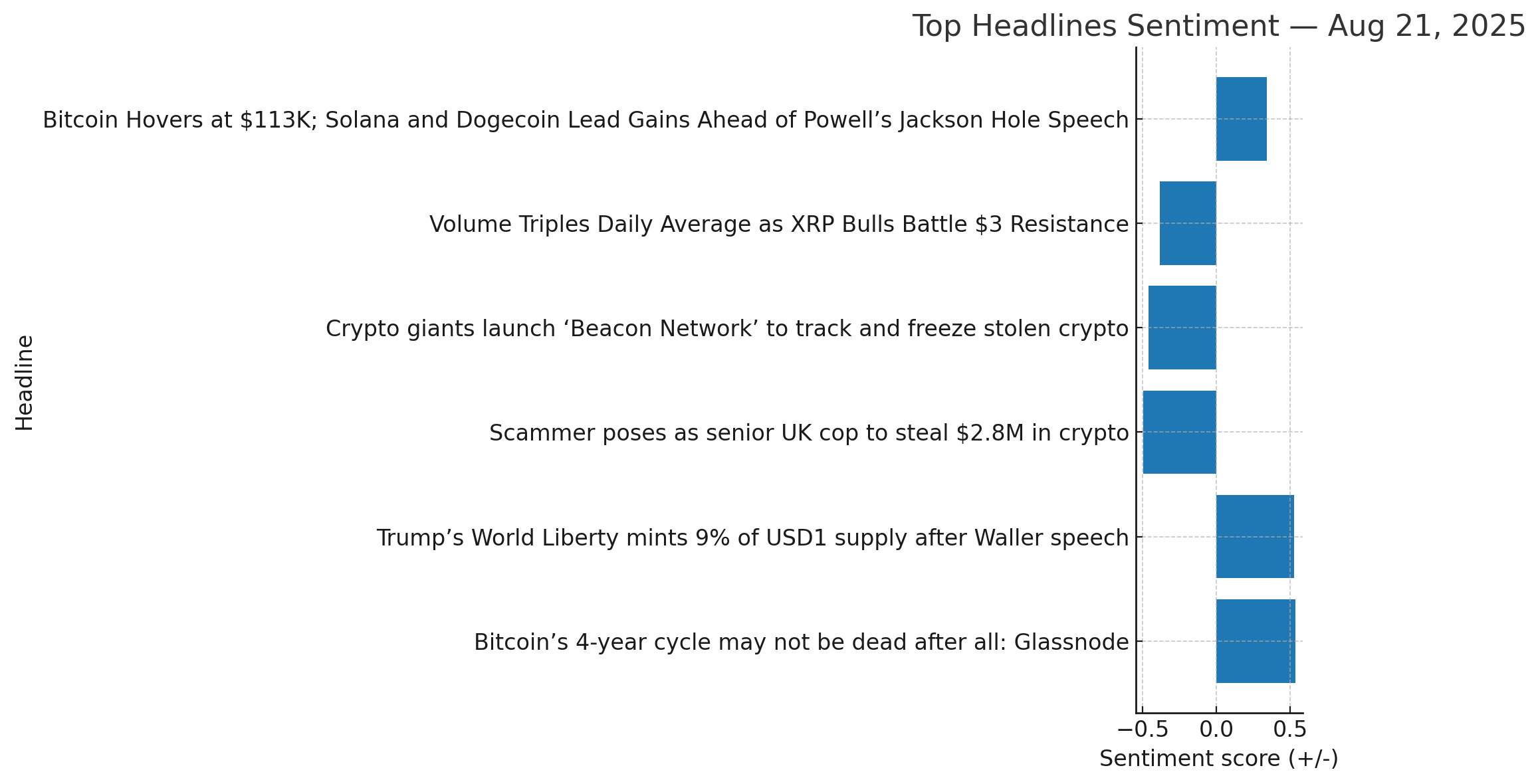

TL;DR: The Bitcoin price today August 22 2025 is holding near $113.1K in the U.S. session. Markets are keyed to Chair Powell’s Jackson Hole remarks, while builders got a confidence boost from a U.S. Justice Department official stressing that writing code without criminal intent isn’t a crime. In Asia, KRW-denominated stablecoin rails on Kaia extended the “fiat-on-chain” theme. Our sentiment feed leaned mildly positive with spikes around policy chatter. Alts were quiet; no fresh signals in XRP, DOGE, or SOL today.

1) Bitcoin Price Today August 22 2025 — The Market’s Main Character

Macro wrote the script today. As we track the Bitcoin price today August 22 2025, BTC was firm but indecisive, holding a steady range around the $113K handle while traders waited for Powell. This setup typically compresses volatility into the announcement window and then releases it in a directional burst once the tone is understood.

For day traders, that argues for patience. Take the market that’s offered, not the one you wish for. Spot flows and futures basis looked orderly, and on-chain activity showed no stress—more like a market catching its breath than one losing altitude. The upside case into the weekend needs a constructive read on growth and inflation, or at least nothing that tightens financial conditions faster than priced. The downside case is less about doom and more about a garden-variety shakeout if real yields perk and the dollar firms into headline risk.

Takeaway: When policy is the main character, trade location matters more than prediction. Let the speech set the tone; react with levels and sizing, not guesses.

2) Momentum Sub-Plots

Unlike yesterday, our token panels did not surface clean, high-conviction signals in XRP, DOGE, or SOL. Volumes rotated in and out, but the combinations of residuals, sentiment, and price behavior that we flag as “actionable” did not line up. When BTC is the axis, many alt narratives stall unless they carry their own catalyst. That wasn’t present this morning, so we keep focus on BTC and macro. If momentum reappears late U.S. session we’ll note it—but forcing trades when the data is quiet is a good way to give back hard-won gains.

3) Adoption You Can Touch: KRW Stablecoin Steps on Kaia

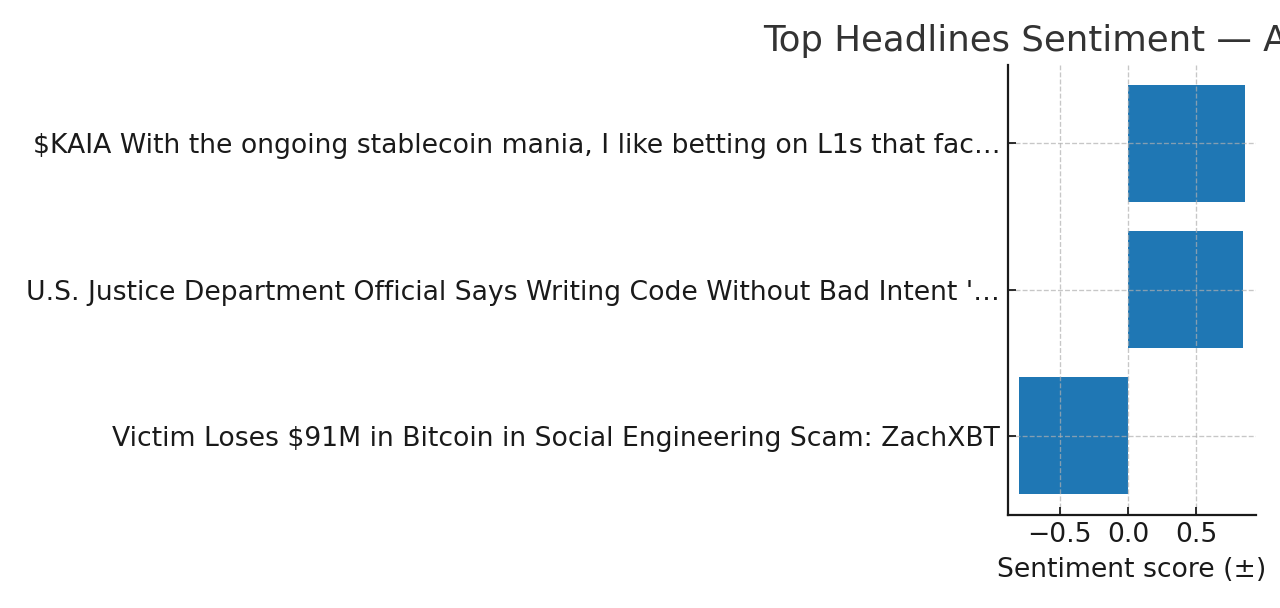

Another brick was laid on the Asian stablecoin wall. Messaging-scale distribution plus fiat-denominated settlement remains the biggest unlock for mainstream use. Today’s Kaia update around KRW rails extends that theme: local-currency pegs enable familiar pricing, while on-chain movement trims friction at the edges.

In practice, these pieces compound slowly and then suddenly. For traders, it’s less about a single ticker and more about liquidity thickness over time. Deeper stablecoin markets usually translate to tighter spreads, stronger dip absorption, and easier transmission of risk appetite across venues. Whether BTC is chewing through resistance or defending support, robust fiat-on-chain plumbing makes every attempt less fragile. For additional adoption context, see CoinDesk markets coverage and CoinTelegraph’s regulation section.

4) Security / Regulation: DOJ Eases Builder Chill

Policy clarity matters because uncertainty is a tax on innovation. A notable line from a U.S. Justice Department official today: writing code, absent bad intent, isn’t a crime. For open-source contributors and protocol engineers, that signal helps reduce the chilling effect from recent enforcement headlines. It doesn’t green-light money laundering or sanctions evasion; it simply draws the line closer to where most developers already operate—design, test, ship, audit.

Expect this to register not as a price candle but as a slow improvement in the developer risk premium. Over quarters, that can mean more experiments, more audits, and more resilient infra. That backdrop is one reason the Bitcoin price today August 22 2025 can hold steady despite headline noise: builders keep building.

5) Narrative Check: Builders Build, Macros Macro

Two currents cross here. Macro decides pace; builders decide direction. If Powell comes in balanced, crypto’s near-term path of least resistance is the one plumbing is already pointing to: stable, boring rails that invite real-world users. If he surprises hawkish, the first-order impact is beta—prices dip, leverage trims. But the second-order effect is that adoption work keeps marching, and those cycles are harder to derail. That’s why we separate the daily tape from the structural tape. Today’s tape was calm; the structural tape kept getting sturdier. Net-net, the outlook for the Bitcoin price today August 22 2025 is cautiously constructive barring a policy surprise.

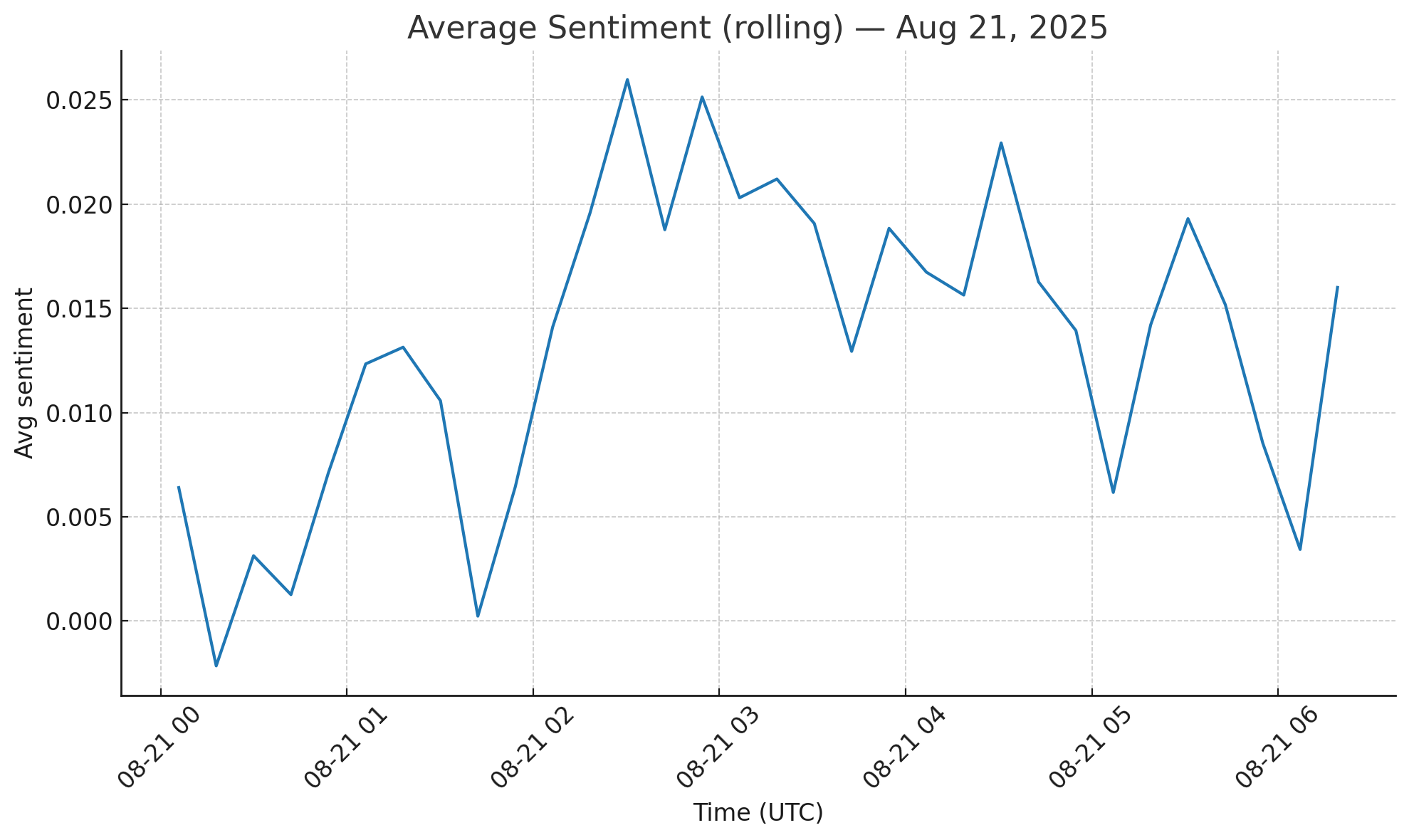

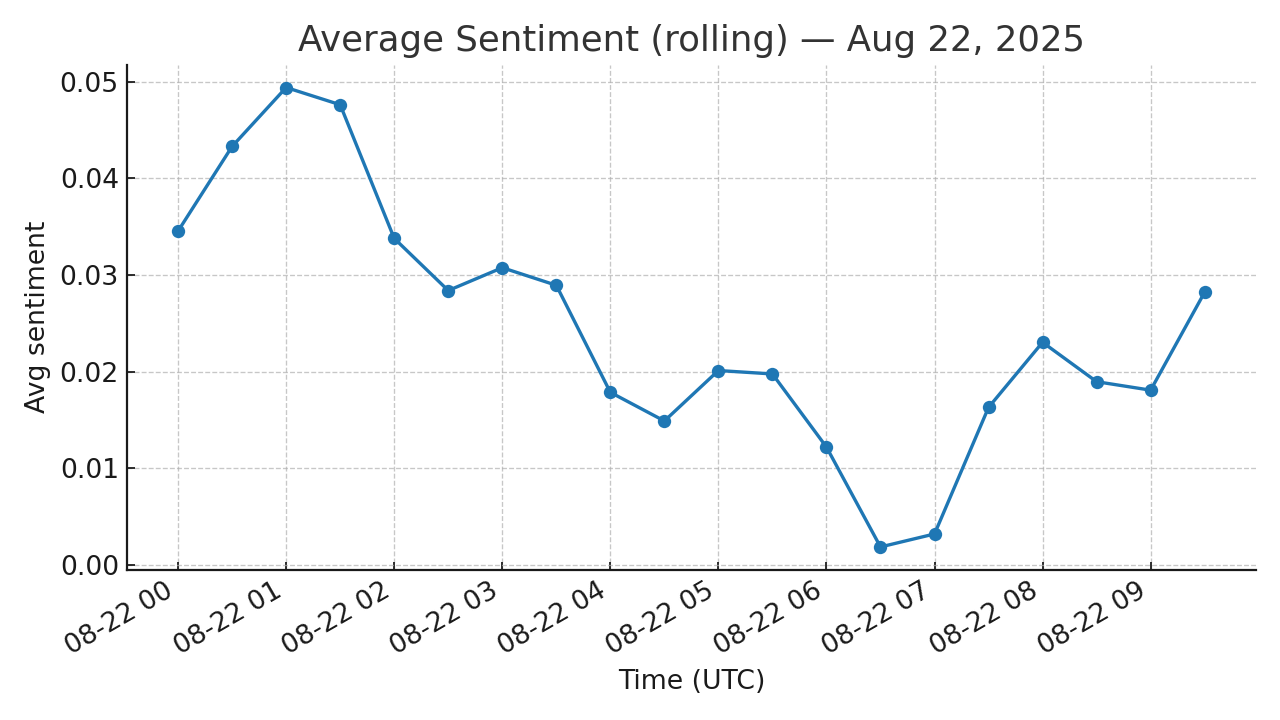

6) What the Crowd Felt (Relikon’s Analytics)

- Items processed today: 2,852

- Average sentiment: +0.024 | Peak: 0.932 | Trough: -0.796

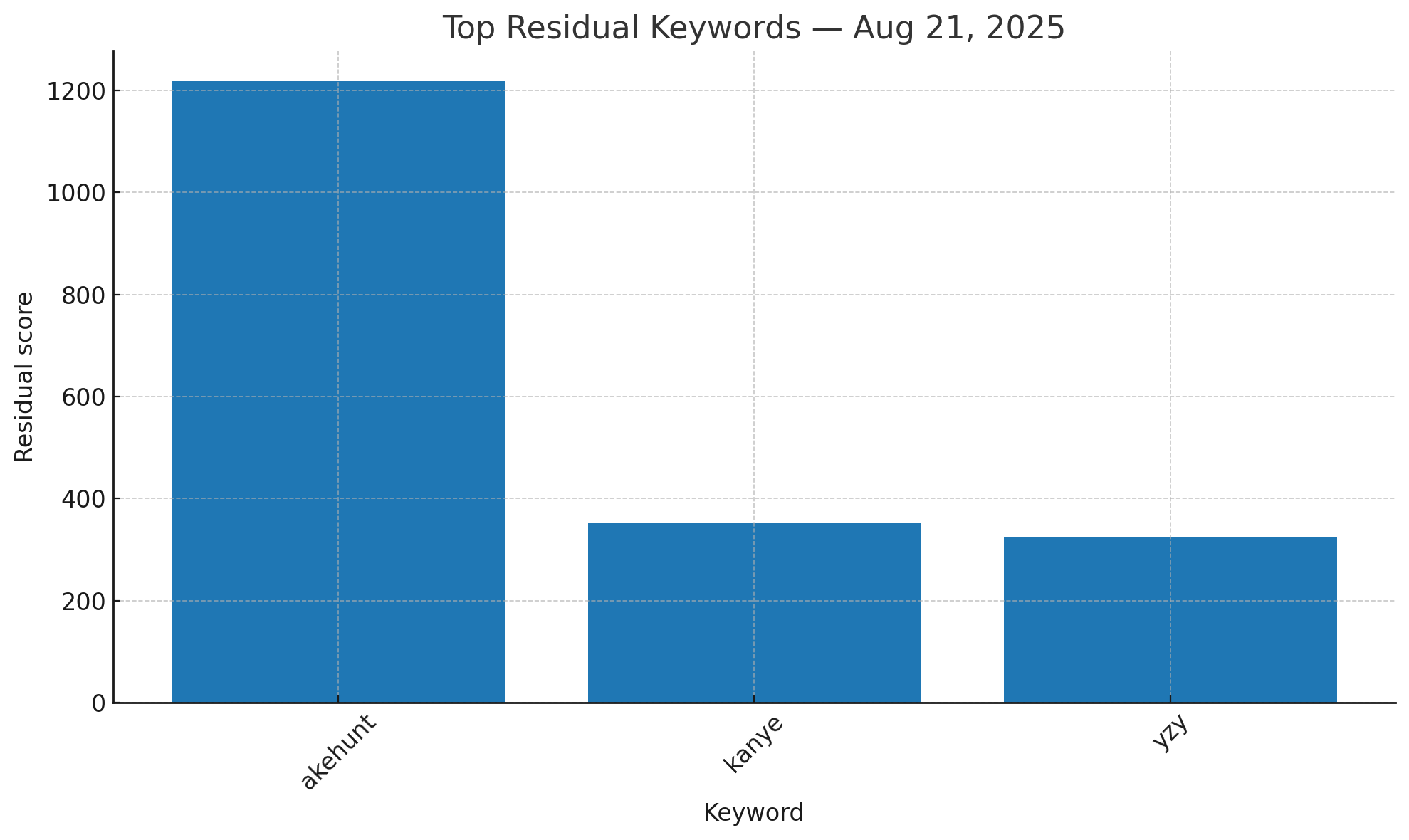

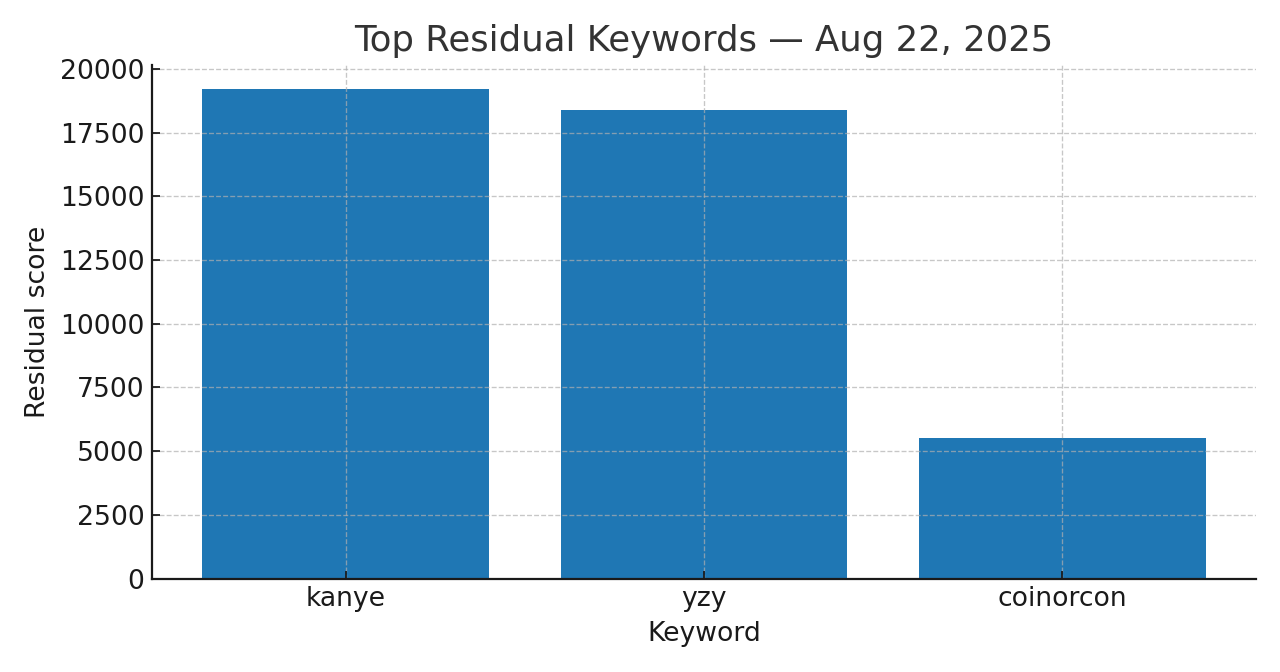

- Residual spikes: YZY, Kanye, Powell — celebrity-token chatter and the policy watch cycle dominated the residuals.

Our rolling line spent Asia and early-Europe above zero, cooled into the New York morning, then recovered modestly. That profile fits a market waiting on macro while digesting builder-centric stories. Residuals captured the undercurrents better than the average: the “Powell” node rose steadily as the speech cycle neared; celebrity-token terms flared and faded; and adoption-adjacent phrases held a small but persistent bid. That mix is classic “risk-on but respectful of the calendar,” which aligns with the Bitcoin price today August 22 2025 holding steady ahead of policy cues.

7) Levels & Setups (Not Financial Advice)

- BTC: ~$113,100. First support sits near ~$112,000 (intraday shelf). A decisive break below risks a liquidity sweep toward ~$110,500–$111,000. On the upside, ~$114,000–$114,500 caps the morning range; acceptance above that band opens a path toward the mid-$115Ks. Around policy events, size down and let post-speech structure confirm—especially if you’re trading the Bitcoin price today August 22 2025 headline flow.

- XRP: — no fresh edge in today’s data.

- DOGE: — no fresh edge in today’s data.

- SOL: — no fresh edge in today’s data.

8) Quick FAQ

Q: What is the Bitcoin price today August 22 2025?

A: Around $113.1K at the time of writing, with range-bound action into the Powell window.

Q: What should I watch next?

A: Powell’s tone on growth and inflation; follow-through in Asian stablecoin deployment; and any builder-policy reaction to the DOJ comments.

Q: Why didn’t you cover XRP, DOGE, or SOL today?

A: Our snapshot and residual filters didn’t surface clean, high-quality signals. We only feature tokens when the data says the edge is there.

9) Social Snippets

Twitter/X: Bitcoin price today Aug 22 2025 ~ $113K into Powell. DOJ: code ≠ crime (intent matters). KRW stablecoin rails on Kaia extend real-world on-chain use. Sentiment mildly green. Charts ⤵️

LinkedIn: Policy clarity lowers builder risk; stable fiat rails widen the funnel. The mix doesn’t always print fireworks, but it raises the floor. Today’s analytics back that up—steady sentiment, adoption bricks stacking, levels defined.

See more analysis and updates on our homepage and browse the latest posts in Relikon’s Crypto News.